New year, new freight market?! We’ll see…

Let’s talk about the current state of the freight market and what CPG shippers are up against heading into 2025.

What Could Impact My Freight in Q1?

Inflation

Inflation can have ripple effects on the cost of fuel, equipment, labor, insurance, and inventory storage. The Federal Reserve sets a target rate of 2% for maximum employment and price stability.

Inflation rates have consistently decreased over the last few months, now residing at 2.7% at the end of December 2024. Rates have hovered around this place since August 2024. We have certainly come a long way since rates slowly skyrocketed up to 9.1% in June 2022.

Fuel Prices

When the price of fuel goes up, carriers are required to increase their rates or take some losses.

In July 2024, we reported an average diesel price of $3.813 per gallon and in October 2024, the price fell to $3.544. As of December 30, 2024, the price sits around $3.503.

Freezing Temperatures & Winter Weather Disruption

The holidays are behind us, which means peak holiday disruption is no longer a hurdle. But freezing temperatures and snow delays are just getting started in many regions of North America.

Freezing temps vary across the U.S., but there are regions that almost always see dangerous cold weather. Typically starting in October and lasting through March, these regions include parts of the Northeast, upper Midwest, Rocky Mountains, and Canada. Although liquids are especially vulnerable, other products can be susceptible to freeze damage without proper precautions. Failure to arm your shipments against this can result in spoiled or destroyed products and cost shippers big.

Click here for more information on how to protect your freight from freezing this winter.

Produce Season

Produce season can impact CPG shippers when carriers begin devoting trucks to moving high crop volumes. This additional volume can tighten capacity, drive up rates, and make for some challenging conditions for shippers who don’t prepare accordingly.

Produce season runs mid-spring through mid-summer for most U.S. states, but there are a few whose peak season runs in the back half of the calendar year. Refrigerated transportation in particular will be at a premium during peak seasons.

Check out our state-by-state produce season guide so you know when and where to expect disruption.

Port Strikes

Back in October 2024, 50,000 dockworkers walked off the job at East and Gulf Coast ports after failing to reach an agreement with ports ownership on a new contract. This was the union’s first strike since 1977 and lasted three days, costing the economy billions.

Just three months after this, lingering conflicts between longshoremen and U.S. port operators mean a potentially disastrous strike could still happen.

The ILA is pushing for the finalized deal to guarantee no additional freight handling automation will be imposed on the industry, which is something the union says will eliminate stevedore jobs. But the USMX says increased robotization is essential to making U.S. ports more efficient and competitive with foreign rivals.

Now, the operators of East and Gulf coast ports have only until January 15 to finalize the contract agreement with workers that averted a prolonged walkout, or risk one capable of disrupting maritime transport—an action that could cost up to $5 billion per day.

January 14, 2025 Update:

A potential crisis at U.S. East and Gulf Coast ports has been averted as the International Longshoremen’s Association and U.S. Maritime Alliance reached a tentative six-year labor agreement, preventing what would have been the second strike in four months.

The agreement comes just days before a January 15 deadline, when a temporary contract extension was set to expire.

Tariffs May Boost Trucking Demand

Many logistics experts are calling the current state of the market “the longest freight recession we’ve ever seen.” It’s been hard to predict if and when the market will boom again.

However, towards the end of 2024, Zipline experts reported seeing small signs that indicate a market flip may be stirring. These usually show up first as service failures and are later followed by statistical evidence like tender rejections and accepted volumes equalizing. Please note a market flip will not happen over night and will likely be slow and steady.

Freightwaves recently reported that President-elect Donald Trump intends to direct a good portion of his tariff escalation on products sourced from China.

The primary goal of U.S. trade policy is to foster advanced manufacturing in sectors like electronics, machinery, pharmaceuticals, medical devices, aerospace, defense, agriculture, and oil and gas. Broad tariffs on Chinese exports encourage shifting supply chains out of China to other global regions.

During Trump’s first term, an agreement was established to make trade with Mexico more attractive than with China, nudging production back to the Americas. This would boost trucking demand, as manufacturing increases freight needs between suppliers, multiplying trips and miles in the manufacturing process.

It’s important to note that tariffs could cause inflation to rise and the Fed may raise it’s benchmark rate. Mortgage rates aren’t directly impacted by this, but they often trend up or down ahead of Fed moves. Mortgage rates are expected to ease slightly this year. However, that forecast could change depending on how the economy evolves in 2025.

If the economy cools too much and a recession looks likely, rates may fall more substantially. Or, if inflation stops decelerating or ticks back up, mortgage rates could rise.

Flatbed Market Variables in 2025

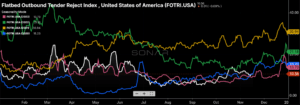

The flatbed tender rejection rate has been gradually rising since July 2024.

Both real estate sales and homebuilding data have a relationship with demand in the flatbed market. Homebuilder optimism can presage a rise in housing starts, which can cause a rise in building material shipments — most of which is moved by rail or flatbed. An increase in new and existing home sales could kickstart consumer spending in several categories that have recently been lagging, such as home renovations and furniture.

Zipline experts report flatbed volumes and rates usually remain consistent throughout the year, but could potentially see some spikes in 2025 depending on how all of these economic factors play out in 2025.

Especially in the winter months, flatbed shipping can get tricky and pricey if shippers aren’t planning ahead and working closely with flatbed experts. Say you’re shipping finished lumber in the middle of unpredictable winter weather.

First, you’ll need a tarp to cover and protect the lumber from the weather and flying debris on the road. Many carriers don’t own tarps long enough to get the job done. You’ll need to track down one who does and will know how to care for your freight properly.

Second, you’ll legally need to equip the truck with snow chain tires to get through severe weather and remove risk of a flatbed backsliding on a slick highway. Note that carriers may charge between $250-500 per tire. And lastly, you’ll likely need to add a step deck and/or rent a forklift to offload the freight once it arrives at the destination.

As you can imagine, the cost of these added protections and services add up quickly and can all be for nothing if you don’t coordinate the details efficiently. This is when partnering with a trusted expert who knows which carriers to work with and which add-on services to book is insanely important.

Let Zipline Logistics Handle Your Freight in 2025

Zipline Logistics is the only third-party logistics solutions provider in North America exclusively servicing the consumer-packaged goods sector. Our uniquely qualified carrier network, world-class team of retail transportation experts, and state-of-the-art shipper intelligence tools maximize client revenue and gross margin by eliminating out-of-stocks through optimized, on-time in-full performance. By focusing on retail-specialization, we have maintained a customer satisfaction score ranking 5 times the industry average throughout consecutive years of award-winning growth.

Zipline processes were built specifically to resolve the most critical logistics challenges faced by consumer goods brands shipping into retail. We tailor strategies to reduce overall transportation spend, optimize retail performance, and beat out the competition for shelf space. 97% of our orders end up on retailer’s shelves such as Walmart, Costco, UNFI and KeHE, and Sam’s Club.

How Are Freight Market Dynamics Trending Into 2025?

“Going into the fourth quarter, we started seeing small signs of a more balanced market than we have in two years,” reports Andrew Lynch, President of Zipline Logistics, “Those early signs typically show up as either service failures, either happening inside of our own walls or from our competitors. And as we start to head into 2025, we’re seeing statistical evidence as well: tender rejections and accepted volume are matching up to indicate a more balanced marketplace.”

For more insights on what’s to come in 2025, tune into The TRUCK YEAH! Podcast presented by Zipline Logistics. This episode features your hosts, Teddy Lee Knox and Jesse Juett along with special guest and President of Zipline Logistics, Andrew Lynch.

Have more questions about the freight market?