It’s July, so you know what that means: we are officially half way through 2024!

As the summer heat intensifies, so do trucking capacity crunches thanks to International Road Check, Memorial Day, the Fourth of July, and Operation Safe Driver Week all stacking up against each other. Not to mention, hurricane season has struck and is already breaking records.

What hurdles might the freight market might throw at us in the third quarter of the year? Read on to find out.

What Could Impact My Freight in Q3?

Inflation

Inflation can have ripple effects on the cost of fuel, equipment, labor, insurance, and inventory storage. The Federal Reserve sets a target rate of 2% for maximum employment and price stability.

Inflation rates have remained consistent over the last few months, residing at 3.3% at the end of June 2024. We have come a long way since rates slowly skyrocketed up to 9.1% in June 2022.

Fuel Prices

When the price of fuel goes up, carriers are required to increase their rates or take some losses.

In September 2023, we reported an average diesel price of $4.58 per gallon and in April 2024 that figure fell to $3.517. As of July 1, the price has increased once again to $3.813.

Logistics ‘Holidays’

As we mentioned in the opener of this article, there’s quite a few events taking place over the next few weeks that usually have ripple effects on capacity. We’re talking traffic back ups in general due to vacationers traveling, slower service due to supply chain workers enjoying time off from work, and transit delays thanks to CVSA blitz weeks in July and August.

During these blitz weeks, law enforcement in Canada, Mexico and the U.S. will be on roadways issuing warnings and citations to commercial motor vehicles engaging in unsafe driving behaviors such as speeding, distracted driving, following too closely, and drunk/drugged driving.

In addition to out-of-service orders that take drivers off the road, many commercial operators choose not to drive during these weeks, which can have a drastic effect on capacity. One of Zipline’s mid-sized East Coast and Midwest-based carrier partners reported somewhere between 30-40% of their owner-operators were not driving during inspection periods in years past.

Hurricane Season

According to Fox Weather, the U.S. mainland only experienced the direct impacts of one hurricane in 2023, resulting in the quietest season for the Lower 48 in more than a decade.

Based on the rapid intensification of Hurricane Beryl (which recently set the record for earliest Category 4 ever), scientists are predicting the 2024 Atlantic Hurricane season will see some of the worst storms in history. The U.S. is predicted to experience 20+ named storms, 10+ hurricanes, and 3-5 major hurricanes.

Hurricanes can bring fierce winds and flooding that damage infrastructure and physical assets. Often in the face of this risk, manufacturers or shipping facilities will shut down operations to avoid jeopardizing the safety of employees and company property. On the carrier side of inclement weather, drivers usually either refuse to go to high-risk markets during storm activity or demand much higher rates in order to do so.

Produce Season

Produce season can impact CPG shippers when carriers begin devoting trucks to moving high crop volumes. This additional volume can tighten capacity, drive up rates, and make for some challenging conditions for shippers who don’t prepare accordingly.

Produce season runs mid-spring through mid-summer for most U.S. states, but there are a few whose peak season runs in the back half of the calendar year. Refrigerated transportation in particular will be at a premium during peak seasons.

Check out our state-by-state produce season guide so you know when and where to expect disruption.

How Are Freight Rates Trending Into Q3?

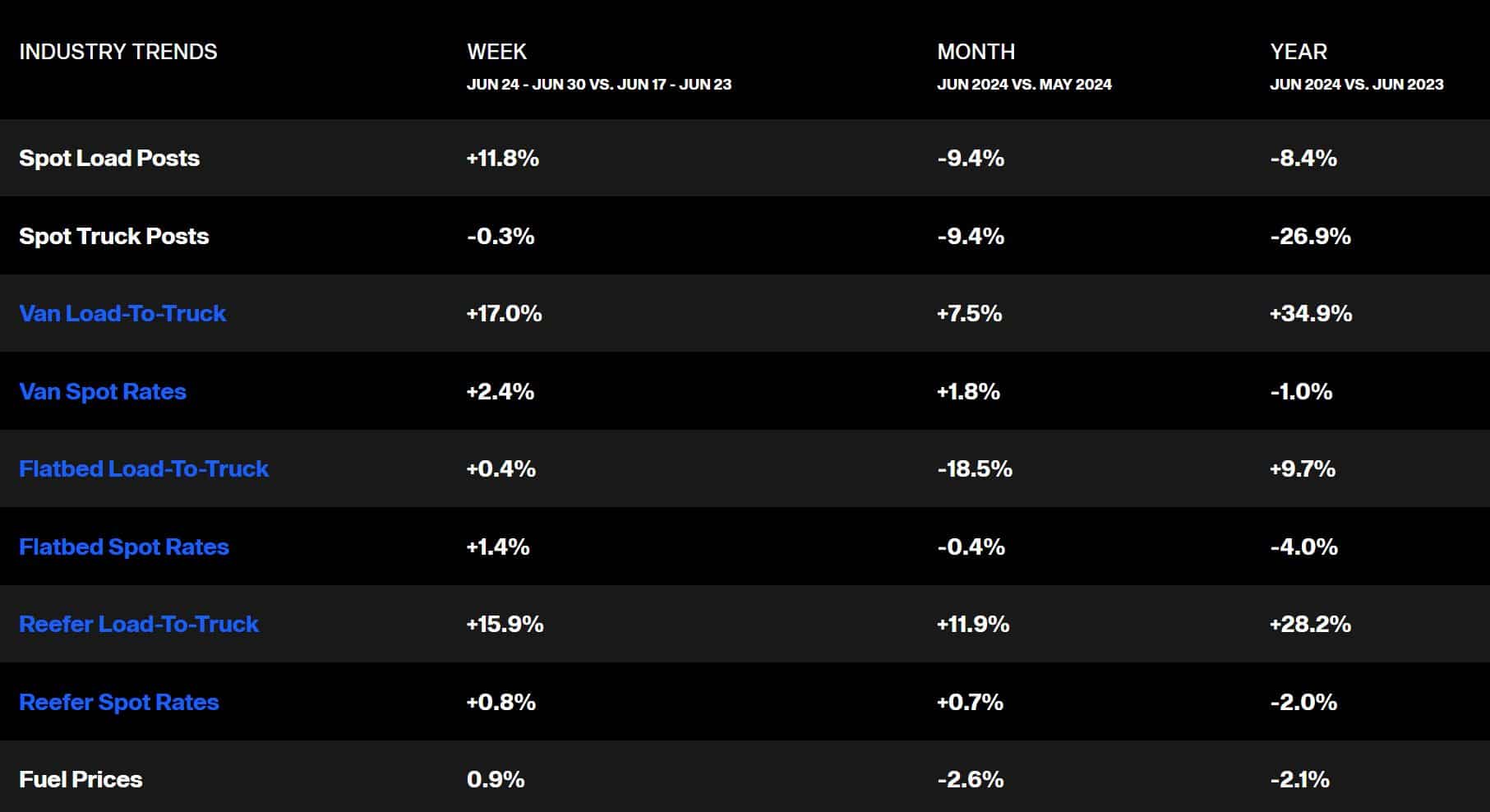

Into the third quarter of the year, we are seeing elevated numbers in overall industry trucking trends because we’re coming off the build up towards a holiday weekend. However, comparing van and reefer spot rates month over month may indicate the beginnings of a market flip — but it’s too early to call it a trend yet.

The chart above depicts the national average dry van rate per mile in the United States. Derived from DAT.

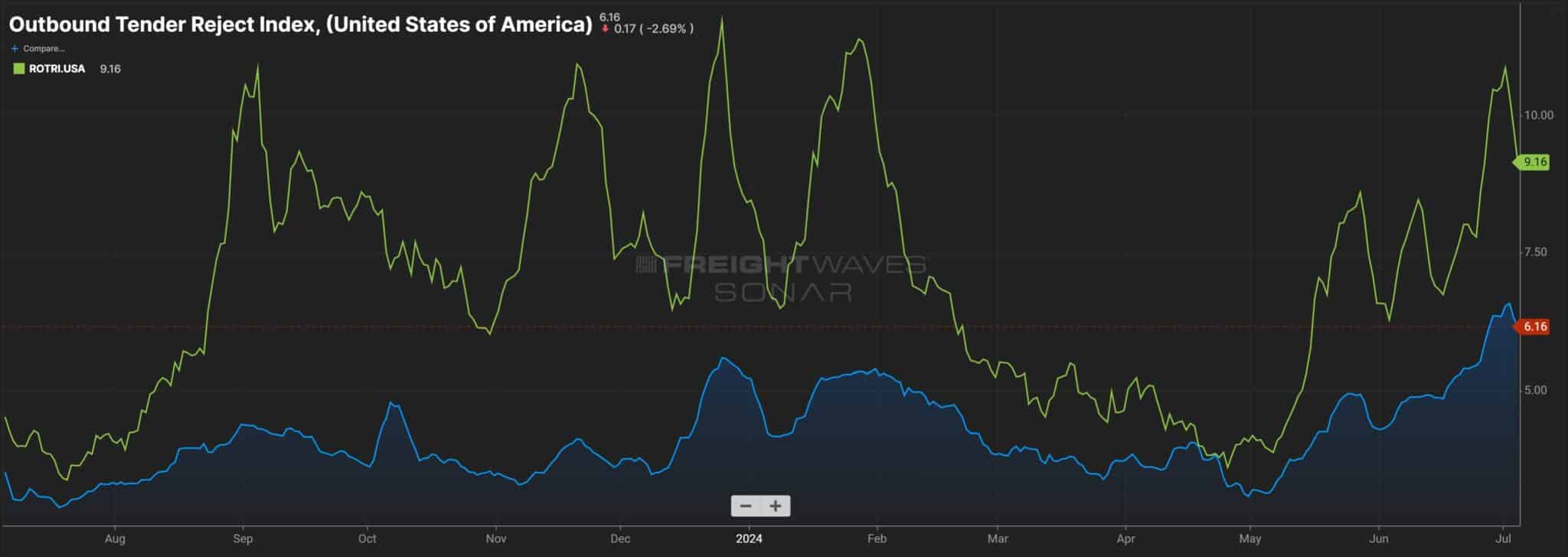

Outbound tender volumes are falling somewhere in between average volumes we saw in 2022 and 2023. Rejections have been steadily increasing since May.

The charts above depict national average outbound tender volumes and rejections in the United States. Derived from FreightWaves SONAR.

Need Help Navigating the Freight Market?

Regardless of an ever-changing freight market, CPG suppliers focused on logistics partnerships rather than freight transactions will be the real winners in 2024. Believe it or not, there are still many aspects of your supply chain that you can control with industry experts on your side.

At Zipline Logistics, we care about each CPG brand’s unique business needs and tailor strategies to reduce overall logistics spend, optimize retail performance, and beat out the competition for shelf space. Zipline processes were built specifically to resolve the most critical logistics challenges faced by consumer goods brands shipping into retail.

We tailor strategies to reduce overall transportation spend, optimize retail performance, and beat out the competition for shelf space. 97% of our orders end up on retailer’s shelves such as Walmart, Costco, Bath & Body Works, Whole Foods, and Best Buy.

Don’t Miss the Next Freight Market Update

Want the inside scoop on breaking news and trends? Sign up for Zipline’s Retail Resources (AKA our monthly e-newsletter) so you don’t miss the next freight market update!