Welcome to 2024! Let’s kick off the year with our usual Q1 Freight Market Update.

Many professionals in the industry will not be disappointed to see the other side of 2023, which was a year of low margins and eating losses for many transportation companies. Will things change in 2024?

Our in-house experts believe so, although it will continue to be a slow process. The market seems poised to flip somewhere during the back half of 2024, so now is the time to sit with your transportation provider and discuss the future. What will rates and capacity look like when the market eventually flips? Is your provider committed to servicing your freight after the market flips and loads are abundant? These are important topics to talk about, as a freight market flip can mean difficult consequences for unprepared CPG brands.

Tune in to the TRUCK YEAH! Podcast to hear Zipline Logistics President, Andrew Lynch, reveal his unfiltered 2024 freight market predictions, tailored for CPG brands.

Economic Factors

Inflation

Inflation rates have (relatively) eased again to a level of 3.1%. This mark is close to the lowest level since early 2021, and the faster-than-expected cooldown has some economists hoping the good news continues.

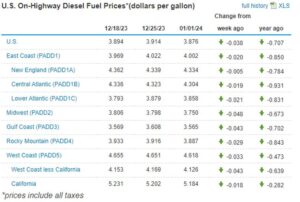

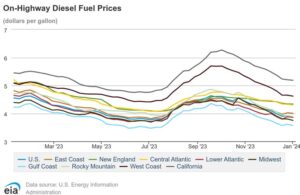

Fuel Prices

Average fuel prices in the US have returned to their slow decline. In September, we reported an average diesel price of $4.58 per gallon. This has now fallen to $3.87, returning close to the line we saw in summer of 2023.

COVID-19

While the immediate effects of the pandemic are mostly a thing of the past now, the paradigm shift that occurred will affect our industry for years to come. Check out this report where industry executives reported that visibility, resilience, and efficiency have become top-of-mind for supply chain managers.

Cost savings will always be desirable, but the significant disruptions that the pandemic brought on logistics operations made executives re-evaluate their supply-chain values, moving flexibility and resilience higher on their priority lists.

Freight Market

Ports and the Red Sea Shipping Route Pause

Global container shipping companies have paused routing shipments through the Red Sea after an attack on a Maersk container vessel over the weekend. Despite the Israel-Hamas conflict, container ships were still moving through the Red Sea under the protection of the military force “Operation Prosperity Guardian.”

Over the weekend, armed militants attacked a Maersk container ship. Other displays of impending violence such as anti-ballistic missiles and gunfire have further threatened the safety of container ships and caused global shipping companies to re-route their ships around the Cape of Good Hope.

Since these attacks, indexes spiked up to 78% on some lanes in a few days. Although intended to be brief, the pause is indefinite as it will be difficult to assess the risk of violence when moving freight through the Red Sea in the coming days and weeks.

LTL and the Yellow Shutdown

The LTL market is in an interesting place after Yellow shuttered operations this summer. Yellow was one of the largest LTL companies in the country, and the fallout from their shutdown is still being calculated by other LTL carriers, clients, and truck drivers.

With the close of 2023, the sell-off has begun. 128 of Yellow’s 169 terminals have been sold. The buyers include other LTL giants XPO, Estes, Saia, and Knight-Swift.

You can read our report from the summer here.

Volumes, Rejections, Rates

National Average Dry Van Rate Per Mile

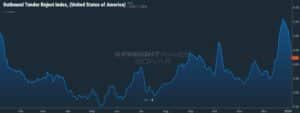

Outbound Tender Rejection Index

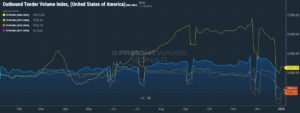

Outbound Tender Volume Index

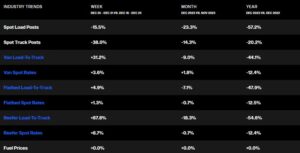

Industry Trends

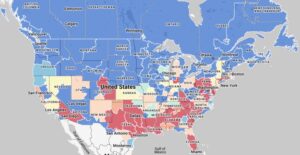

Outbound Dry Van Market Heat Map

Inbound Dry Van Market Heat Map

National Average Fuel Rates

Retailers

Based on IRI data, the beverage industry was out-of-stock on average 10% in December 2023. In just one category – we will use water as an example – that equates to $180 Million in revenue opportunity cost left on the shelf in just a single week.

The packaged food industry was also out-of-stock on average 10% in December 2023. In just one category – we will use snacks as an example – that equates to $146 Million in revenue opportunity cost left on the shelf in a single week.

Retail Buyer Data

Even in a soft freight market, retailers are being picky with the brands they choose to work with. In a survey of retail buyers, 90% said a supplier’s ability to deliver on time impacts their purchasing behavior of that brand and 66% have ended relationships with suppliers over delivery issues.

Navigating the Freight Market

Regardless of an ever-changing freight market, CPG suppliers focused on logistics partnerships rather than freight transactions will be the real winners in 2023. Believe it or not, there are still many aspects of your supply chain that you can control with industry experts on your side.

At Zipline Logistics, we care about each CPG brand’s unique business needs and tailor strategies to reduce overall logistics spend, optimize retail performance, and beat out the competition for shelf space. Zipline processes were built specifically to resolve the most critical logistics challenges faced by consumer goods brands shipping into retail.

We tailor strategies to reduce overall transportation spend, optimize retail performance, and beat out the competition for shelf space. 97% of our orders end up on retailer’s shelves such as Walmart, Costco, Bath & Body Works, Whole Foods, and Best Buy.

Don’t Miss the Next Freight Market Update

Want the inside scoop on breaking news and trends? Sign up for Zipline’s monthly e-newsletter so you don’t miss the next freight market update!